Experience the ease of instant fund transfers and secure transactions with our UPI solutions, simplifying your payment experience.

Our UPI solutions offer a streamlined approach to payments, ensuring seamless transactions and enhanced convenience for users.

Swiftly transfer funds between accounts with our UPI solutions, reducing transaction times and enhancing efficiency.

Seamlessly transfer funds across various banks and payment apps, ensuring compatibility and ease of use.

Receive instant confirmation for successful transactions, providing assurance and peace of mind.

Utilize secure authentication methods such as MPIN and biometric verification to authorize transactions securely

Send personalized payment requests to individuals or businesses, simplifying the payment process for both parties.

Enjoy increased transaction limits, allowing for larger transfers and greater financial flexibility.

Seamlessly integrate UPI across multiple platforms and apps, ensuring a cohesive payment experience.

Tailor payment requests with personalized messages and branding elements, enhancing user engagement.

Utilize artificial intelligence algorithms to detect and prevent fraudulent activities, safeguarding transactions.

Utilize cutting-edge encryption techniques to protect sensitive data, ensuring secure transmission of UPI transactions.

Employ advanced algorithms to detect and prevent fraudulent activities in real-time, enhancing the security of UPI transactions.

Adhere to strict PCI DSS compliance standards to ensure the highest level of data security and protection for UPI payments.

Implement tokenization to replace sensitive UPI data with unique tokens, minimizing the risk of data breaches and enhancing security.

Offer an extra layer of security with two-factor authentication, requiring users to provide additional verification for UPI transactions.

Conduct frequent security audits and assessments to identify vulnerabilities and ensure continuous improvement in UPI transaction security.

UPI facilitates instant fund transfers by allowing users to link their bank accounts to a UPI-enabled app and transfer funds instantly using a unique virtual payment address (VPA) or scanning QR codes. Transactions occur in real-time, enabling immediate transfer of funds between parties.

UPI transactions are secured through multiple layers of security measures, including:

Yes, there are transaction limits associated with UPI. These limits vary depending on the bank and the UPI-enabled app used by the user. Banks may impose daily or per-transaction limits to ensure security and prevent misuse of the UPI system.

Yes, UPI is interoperable across various banks and payment apps. Users can transfer funds between different bank accounts and payment apps seamlessly, regardless of the bank or app used by the sender and receiver.

Yes, many UPI-enabled apps allow users to personalize payment requests by adding custom messages or descriptions. This feature enhances user engagement and helps in providing additional context for the payment request.

Integrating UPI into existing payment systems involves collaborating with a bank or a payment service provider that supports UPI transactions. Businesses can integrate UPI by incorporating UPI-enabled payment gateways or APIs into their websites, mobile apps, or POS systems. The integration process may require technical expertise and coordination with the respective bank or payment service provider.

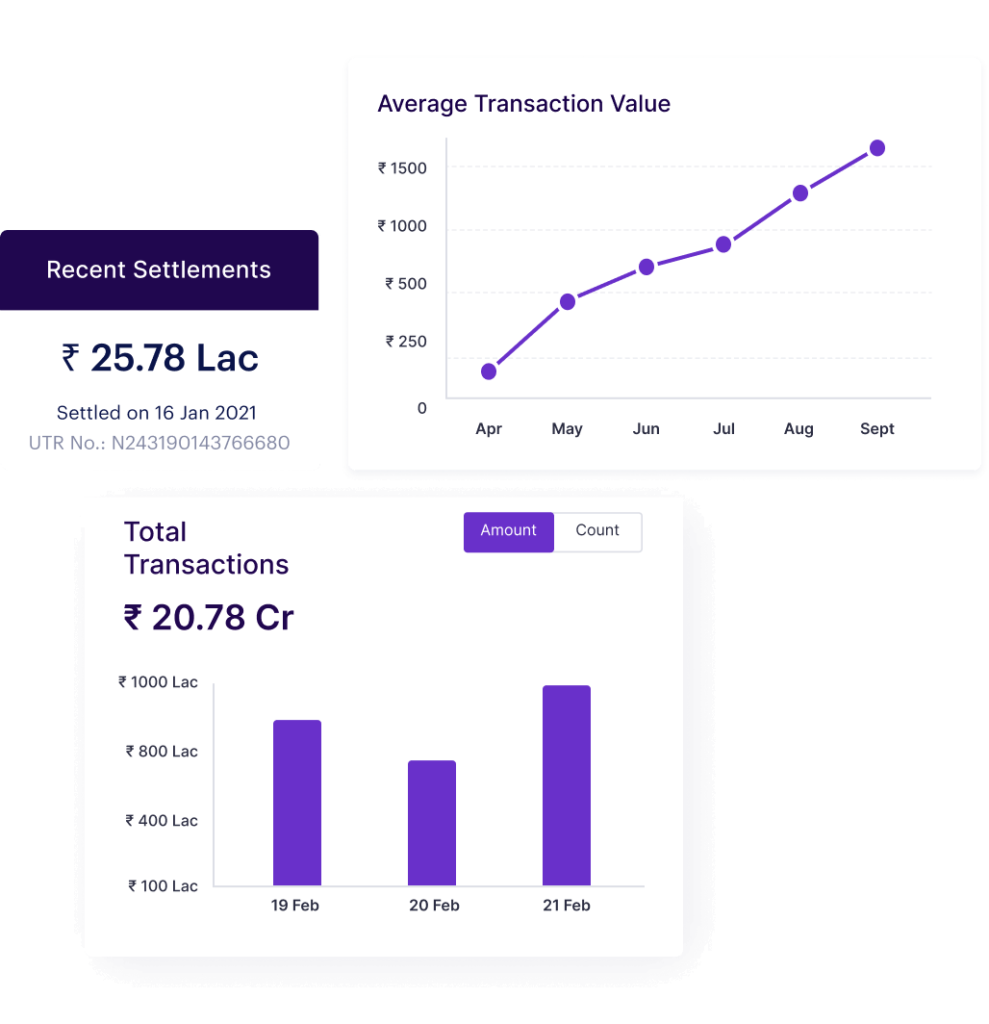

We are committed to revolutionizing the way businesses handle transactions online. With our cutting-edge payment solutions, we empower businesses of all sizes to accept payments swiftly, securely, and seamlessly.

hello@airflypay.in